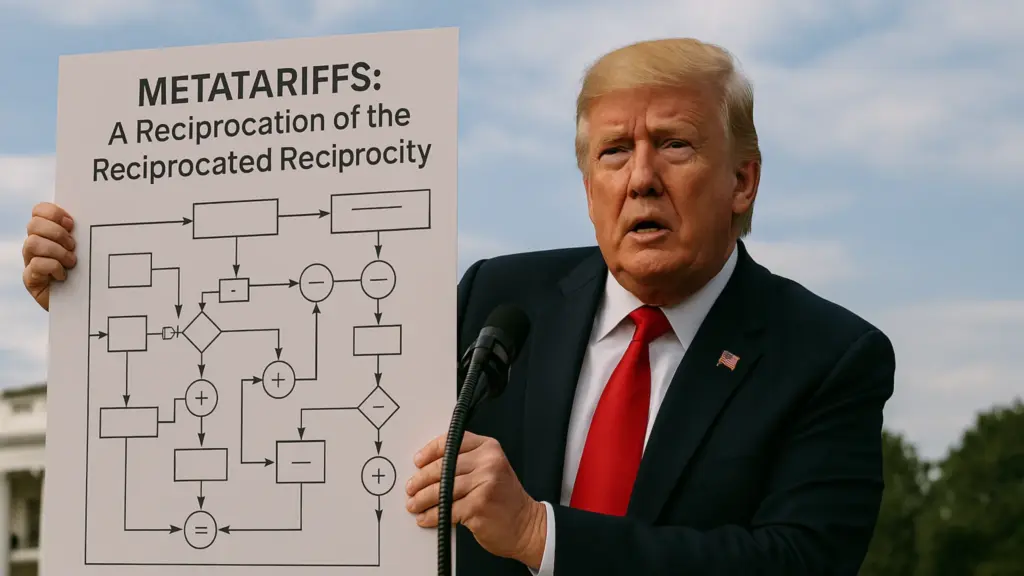

WASHINGTON D.C. – On February 1st, Donald Trump announced new tariffs on Canadian, Mexican, and Chinese goods. But behind closed doors, he signed another executive order – one that targets a rather unexpected asset.

“I don’t know how this Bitcoin thingy works, but I guess it’s coming from China!” Donald Trump declared moments before signing an executive order imposing tariffs on Bitcoin. Effective immediately, the U.S. Customs and Border Protection is tasked with halting Bitcoin transactions at the border and charging tariffs to “help boost the American economy.” When asked how this would be enforced, the president confidently assured reporters: “We have a concept of a plan. It will be tremendous. A big one!”

Crypto Traders in Panic

With a market cap of $2 trillion, Bitcoin has become the go-to asset for crypto traders. But now, the new tariff is shaking the crypto community.

“I’m still hodling and putting every penny I have into it – my grandma’s savings, my neighbor’s money, my kids’ college fund. Bitcoin to Jupiter!” declared one anonymous crypto bro. Well, almost anonymous – his name is Bernie Sanders. Unbelievable.

The Logic Behind the Bitcoin Tariff

According to White House sources, the Bitcoin tariff follows the same rationale as previous trade measures: “We want to force foreign companies to relocate their manufacturing to the U.S. and help our country prosper again. We have plenty of land where companies can start digging for Bitcoin,” explained a spokesperson.

Florida has already announced plans to support local Bitcoin production. “Here in Miami, we’re proud to have some of the most adventurous shipwrecks waiting to be discovered in the ocean. I’ve heard that Bitcoins are still buried in those wrecks. But one thing’s for sure – there’s nothing valuable at the end of a rainbow,” said Florida Governor Ron DeSantis as he set a rainbow flag on fire.

What About Other Cryptocurrencies?

Meanwhile, other digital assets like Ethereum and Dogecoin are experiencing extreme market volatility. “They could go up, down, or stay exactly where they were yesterday,” a crypto analyst observed with piercing insight.

One coin, however, remains untouched by the president: the official TrumpCoin. “I mean, it’s already teetering on the edge of total worthlessness. No further intervention is needed to accelerate its collapse,” the analyst concluded.

Craving more news? Nike merges with a rival shoe brand, while Jerome Powell sends markets into free fall.